How to Achieve Real-Time Insights for Fraud Detection

As the volume of global digital activity and financial transactions continues to grow, instances of fraud have become more prevalent and more difficult to detect. Fraud detection is a major concern across industries because of what’s at stake. It’s critical for businesses to preserve reputation and revenue, reduce financial risk, and maintain high customer satisfaction.

Cybercriminals act fast and have developed sophisticated methods to avoid being spotted, so fraud detection and remediation cannot lag behind. Automated fraud detection is the best path forward: However, detecting fraud automatically can be a complex technical puzzle of its own. For instance, fusing data from multiple sources, as well as combining streaming data with historical data, has traditionally been difficult to accomplish without incurring high latency or operating costs.

To help you understand the importance of effective real-time fraud detection, this blog will break down:

- Why real-time insights are essential for fraud detection

- The best approach to effective fraud detection

- Examples of fraud detection use cases

- Why are real-time insights essentials for fraud detection?

Combating fraud effectively requires real-time analysis from multiple data sources, insight prioritization, and rapid response. It is not helpful to detect fraud and take action hours or even minutes after the act, as the damage has already been done (and could even become more severe).

Fraud is not being detected and mitigated fast enough in many cases. In fact, things seem to be trending in the opposite direction. According to the FTC, U.S. consumers reported losing more than $5.8 billion to fraud in 2021, an increase of over 70% compared to the previous year.

In an effort to move fraud detection closer to real-time, a growing number of organizations are striving to use the continuous flow of information generated by many different sources — also known as streaming data. Processing, storage, and integration are examples of enabling streaming data movement while streaming analytics refers to the inspection of the data being moved and the movement itself.

Although it is feasible to use stream processing and analytics to surface insights that are close to real-time, such methods leave something to be desired when it comes to fraud detection. What if there were a way to unlock true real-time insights, visualize data in concert, and facilitate intervention at the earliest possible moment?

What is the best way to detect fraud effectively?

From a technical standpoint, fraud detection revolves around a need to understand the meaning of streaming data in context — in real-time and at scale — while also programming autonomous action to respond based on that meaning.

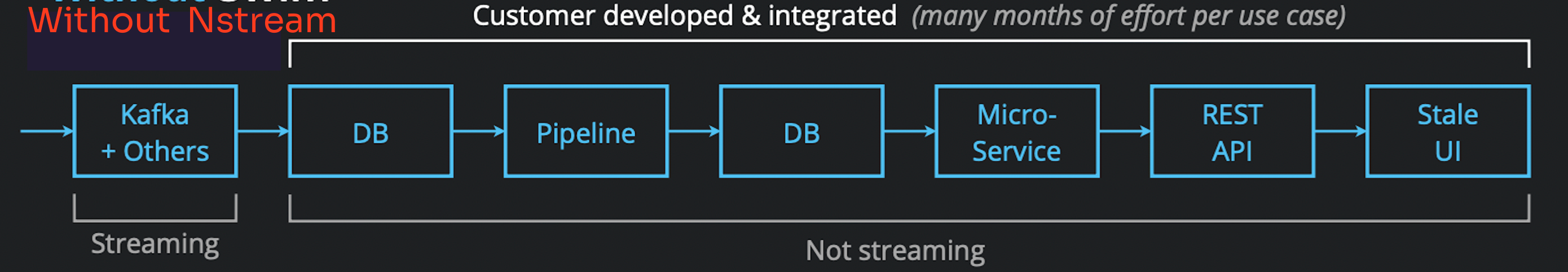

Traditional stream processing architecture (example) does not tick all of these boxes because it requires a complex architecture that ends up breaking streaming context at multiple points in the process due to incurring disk-based latency. It takes more effort to express the “real-world relatedness” of things to derive insights and run decision automation. Such an architecture also forces companies to make cost and feasibility trade-offs regarding what data gets stored and what data gets dropped.

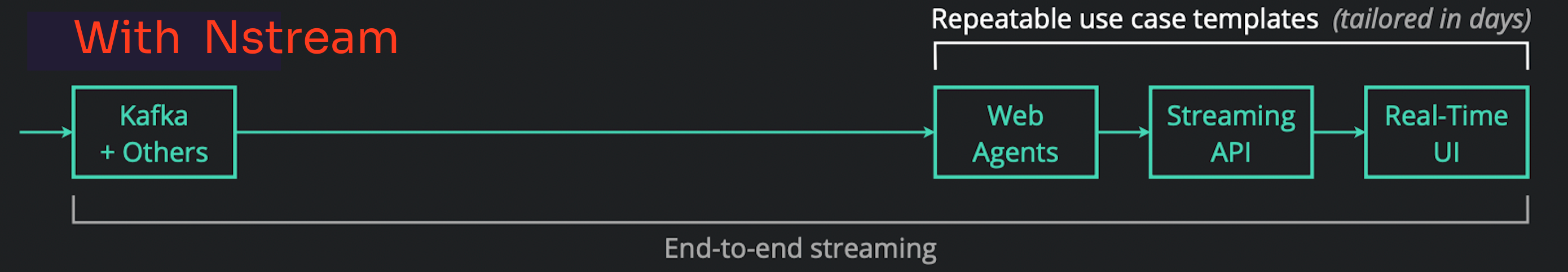

But there is a way for companies to understand what’s going on, derive meaning from streaming data, and automatically respond in real-time: web-addressable stateful objects, also known as Web Agents, which are similar to actors in an actor system.

Web Agents are stateful because they preserve their data and utilize context locally between operations. This keeps latency low because they don’t need to wait on database round trips — the required context is already on-hand and continuously updated. Streaming APIs are used to communicate state changes to other Web Agents and downstream applications (real-time user interfaces, notification systems, etc.).

To recap, Web Agents:

- Are stateful objects that execute business logic on streams using available context.

- Link together to represent real-world relationships and share state.

- Leverage streaming APIs to deliver continuously updated insights.

- Analyze, learn, and predict based on their shared state.

- Stream their analysis and/or predictions in real time over their links.

Web Agents tasked with answering business-critical questions (e.g., Has fraud occurred?) continuously compute their own contextual KPIs (e.g., fraud rate and final approval rate), proactively inform users about what they need to know at the right time (e.g., sending a subscriber an alert about suspicious activity), and even take autonomous remediating action, when appropriate (e.g., freezing an account to prevent fraud).

SwimOS is the best way to allow stateful objects (Web Agents) to answer these questions, in real-time, against a complete working set of relevant data. This open-source project provides the ability to keep a vast number of real-time data streams in sync with half-ping network latency so that at any point in time, business logic can be executed against the most current business state available at entity-level granularity.

Examples of fraud detection use cases

Detecting credit card fraud

Scenario: A financial services company must detect and stop credit card compromises and illegitimate transactions to mitigate damage. Doing so requires enriching streaming data, such as location information and current activity, with historical data, such as spending habits and past transactions.

Solution: First, the financial services company would create a Web Agent for each customer. Next, historical data for each customer (spending habits, past transactions, etc.) would be loaded. Moving forward, each financial transaction would be sent to a customer’s Web Agent which would execute fraud detection logic by accessing local historical data. The results of these computations would then be stored as part of the new “state” of each Web Agent, which could be programmed to trigger alerts about suspicious activity and suspend a credit card if fraud is suspected.

Recognizing malicious telecom activity

Scenario: A telecommunications company needs to reconcile information between cell phone activity and credit card activity to determine if fraud is happening. In the past, it has used an elaborate stream processing model performed on a data warehouse, but flagging suspicious activity took far too long — up to an hour or more.

Solution: First, the telecom company would create a Web Agent for each subscriber. Next, historical data would be loaded for each subscriber (geographical location, mobile and financial activity, etc.). Then each customer’s Web Agent would carry out fraud detection logic against local historical data and store the results as new “state.” For instance, this might entail automatically correlating and analyzing location information and digital activity to determine if someone is making phone calls in one location while their credit card is used in another area. The execution of business logic could also involve adaptive learning about a customer’s behavior to identify new patterns that may seem fraudulent but are legitimate (or vice versa).

Responding to rogue gamers

Scenario: A video game company needs to detect and remediate threats or suspicious actions from users. To do this effectively, the business must be able to analyze game logs and telemetry data in real-time, as well as information about each user, such as location, account information, and game log data.

Solution: First, the video game company would create a Web Agent for each gamer. Next, historical data for each gamer (user profile, past activity, etc.) would be loaded. Then, new streaming data from games played would be sent to each gamer’s Web Agent which would execute fraud detection logic by accessing local historical data. For example, a report filed against a user for spamming could trigger an analysis of their game activity and an automatic ban issued if they are found guilty.

Try SwimOS for your fraud use case

Real-time fraud detection may sound like a tall order, but it doesn’t have to be as complex as others make it seem. Web Agents offer the most efficient approach to gaining insights from real-world events and automatically responding, all in real-time.

If you’d like to experiment with Web Agents for your fraud prevention use case, check out SwimOS to get up and running with an open-source implementation of Web Agents today.

Interested in using low-code, configurable templates to accelerate time to value for your top streaming data use cases? Learn more about Nstream Cloud, the first full-stack streaming data application platform built by developers, for developers